History tells us that interest rates tend to go up much more quickly than they come down.

A brief primer

- Variable mortgage rates are driven by the Bank of Canada’s (BoC) Overnight Rate, as it effectively determines the banks’ Prime Rates. The banks offer discounts to their Prime Rate to mortgage borrowers, and those discounts fluctuate with market conditions.

- Fixed mortgage rates are primarily driven by the yields on Government of Canada bonds. 5-year bonds drive 5-year fixed rates. And those yields are driven by how the markets believe the national and world economies will perform going forward based on their expectations for inflation, GDP growth and other key economic measures, along with some guesswork…

So with all that in mind, here’s what’s been happening…

On October 27th the Bank of Canada left the Overnight Rate unchanged (which drives Variable rates). If you saw that headline and thought mortgage interest rates would remain unchanged, you might be in for a surprise. That is because the other half of the message was that the BoC was ending its QE bond buying program. Other Central Banks around the world are now beginning to taper their QE. Ours is done, fini, kaputt. And that QE program saw the purchase of hundreds of billions of dollars of Gov of Canada bonds during the pandemic, which in turn improved market liquidity, and kept those same bond yields artificially low. The Bank of Canada now owns c. 45% of all Gov’t of Canada bonds.

On Fixed rates

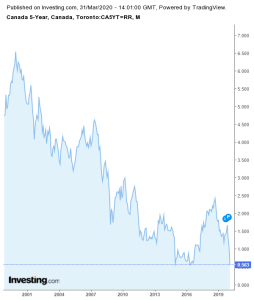

The announcement ending the QE program unleashed a run-up in Gov of Canada bond yields, which landed on top of the steady yield increases that began in late September. And so with that, poof, our era of ultra-low Fixed interest rates appears to be over.

We’ve gone from a 5-year Gov of Canada bond yield of 0.85% to 1.50%, an increase of 0.65%, in less than 6 weeks. So now Fixed rates are higher than they have been since the end of 2019, almost 2 years. But…they’re still historically low. They just feel high right now.

On Variable rates

Markets are currently pricing in four or five BoC hikes to the Overnight Rate by the end of 2022. Each increase is normally 0.25%. So that indicates a potential Prime Rate increase from the current 2.45% to as high as 3.70% by end 2022, maybe.

Even if we do see five rate hikes in 2022 most Variable rate borrowers will still enjoy mortgage rates easily below 3%. The last time we saw Variable rates above that was somewhere around 2008. We are still seeing steep discounts to Prime, with rates of Prime -1.0% and even lower with some lenders on certain products, all the way down to Prime -1.30%.

Sidebar – If you want to know how to determine when to convert a Variable rate mortgage to a fixed rate read my blog post The Fixed vs Variable Interest Rate Decision and scroll to the section near the bottom and is titled If I choose a Variable rate and I want to be able to convert that to a Fixed rate, how will I know when it is time to convert to a fixed rate?

So it seems we have now come off the bottom in terms of interest rates

How high they will go no-one really knows, and there are varying predictions from experts, from ‘not much higher’ all the way to ‘to the moon’.

Suffice to say that rates are still historically low, although it won’t feel that way for a few weeks or months until we get used to this new normal. I remember not that many years ago getting a 3.59% rate on a rental property and thinking “Wow, it sure is nice to be well under 4 %!”

Also remember that we have been qualifying under the stress test’s Benchmark Rate for several years now, and that rate is currently 5.25%. That has ensured that we all have some financial capacity to handle higher interest rates (read payments). Although that might impact some discretionary spending habits, we will be ok.

With change comes opportunity, and also risk

Opportunities always appear when things change in our world. Those who pay close attention will see some opportunities in this what this changing interest rate market creates. Some will be short term opportunities, and some longer term.

On the risk management side – it is always important to think about how you might want to act to protect yourself from outcomes that could cause you some pain. Talk to people who’s opinions and advice you respect and trust.

A few things some might want to consider

- If you now have a Preapproval in place take a look at the expiry date for the rate that is held for you. That is the date the mortgage must fund by in order to get that rate. It is surely lower than what you could get now. Talk with your Mortgage Broker if you have questions on what that means for you.

- If you are thinking of making a purchase then now is the time to get a Preapproval, in case rates continue to increase.

- If you have a Variable rate, is it time to lock your rate in to a Fixed rate? Knowing how you would you determine that is an important question. I have a suggested methodology for handling that. Feel free send me an email requesting it and I will send it to you.

- Do you need access to capital to act on investments or for other needs? Would a Line of Credit (HELOC) work for that?

- Is it time to refinance your home or rental property while rates are still reasonably low? An analysis might be in order.

- Do you have some higher cost debt you would like to pay down? What is the best way for you to do that? An analysis might be in order.

I’m always up for a call to discuss these or any other questions you may have. You can email me, or call me, and leave a message if you miss me, or email me with to request a Zoom or phone call with your available days and times.