What Direction are Interest Rates Headed, and what should we do?

- Context – Let’s first look at the key elements and actions driving interest rates and economic activity right now

- Liquidity crisis

- Remember 2008. The capital markets dried up and the huge gaps had to be filled. Now is similar but with an entirely non-economic cause.

- “The Bank of Canada (BoC) is meeting twice a week with the senior leadership of the Big-Six Banks. The cost of funds for the banks has risen sharply. CMHC is buying large volumes of mortgages from the banks, which, along with CMB purchases by the central bank, will shore up liquidity.” Dr. Sherry Cooper of DLC

- Liquidity crisis

- CMHC has acted to provide liquidity for the Banks by buying large tranches of mortgages and has bumped the quantity of those purchases once already. This frees up lending capacity for the banks by returning the cash to their balance sheets.

- The Federal Government has acted to provide liquidity for businesses by way of loans, tax and other deferrals

- The Federal Government has announced a new program, the Canada Emergency Wage Subsidy (CEWS) program which is to provide to companies that have a 30% loss of revenue up to a 75% wage subsidy to help Businesses keep & return workers to payroll retroactive to March 15. The initial announcement indicated that payments will be capped at 75% of $58,700 an employee’s annual income, so $1,129 per week for up to 12 weeks (again these are the initial indications, yet to be fully unveiled, because, well they’re more than likely not yet fully decided).

- The Federal government has acted to provide liquidity for individuals with several programs, the largest being the $2,000 monthly to all with COVID-related loss of income.

- Bank of Canada has acted to provide liquidity for businesses and individuals by lowering the Overnight Target Rate 3 times in 10 days, a total of 1.50%. Biggest and fastest cuts ever.

- Commercial financing is largely frozen right now.

- Paradox – the Prime rate has dropped by 1.50% in the last 2 weeks, but mortgage rates are going up

- Background

- Prime directly drives only Variable Rate mortgages and HELOC’s and Personal Lines of Credit (PLC).

- Fixed rates are driven primarily by Government of Canada Bond Yields.

- Hi-ratio insured mortgage rates are lower than uninsured rates. That is counter-intuitive to the inherent relative risks and is due to mortgage regulatory changes of recent years.

- Variable rates are down by 1.50%, but the discounts to Prime have nearly disappeared.

- Hi ratio insured from Prime less 1.0% or better, to Prime less 0.2% at best.

- Uninsured from Prime less 0.5% or better, to Prime less 0.0% at best.

- Fixed rates are wildly gyrating, the first increases ~2 weeks ago was about increasing spreads on banks cost of money. Since then it is supply and demand, due to reduced staffing levels, massive inflow of mortgage payment deferrals calls, and huge volumes of applications (now dropping).

- Due to the above: Fixed rates are up ~0.50% over the last week, a bit less for hi-ratio insured mortgages, after dropping initially when the Bond market yields crashed.

- Background

- Where we are today – see these self-explanatory three CHARTS below:

https://www.ratehub.ca/prime-mortgage-rate-history

https://www.ratehub.ca/5-year-variable-mortgage-rate-history

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

- Normal BoC action: inflation low — rate low; inflation high — rate high (and why)

- BoC mandate is to keep inflation within a range, that is adjusted from time to time.

- For the foreseeable future, liquidity issues will be paramount. That will last at least until our economy, and that of our major trading partners, is largely back up and running.

- Why rates might go up instead?

- Currently lenders can’t keep up – very high new mortgage applications during February and early March. This will return to near-normal as deferral calls diminish, and buyers stop buying.

- Risk – Michael Campbell’s MoneyTalks comments this week:

- “What happens when lenders worry about mid-term and long-term lending? Then you have no market”

- “How long can Central Banks keep interest rates low when increasing risk demands that they rise? It’s like loading a spring. Will it take 1 month, 12 months, 18 months? No-one knows, but the risk is there.”

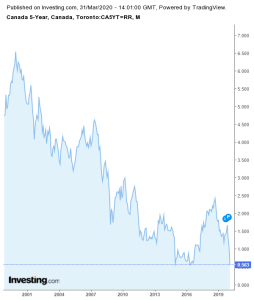

- What happens if Canada’s government takes on so much debt that institutional and international investors who buy those bonds begin to demand higher, perhaps much higher, returns on those bonds. And if the same occurs in most of the rest of the developed world it seems to me the impact of that would be a scarcity of capital. These things would yield increased inflation and in turn higher interest rates for Canadians. See the below chart of the Government of Canada 5-year Bond yields from 2000 to March 30, 2020. How far yields have fallen. These have been an extraordinary last 20 years, especially the last 12 since 2008.

- What to expect over the next 90-180 days

- Variable Rate Mortgages: discounts to the Banks’ Prime Rates: Have all-but disappeared, and I don’t see that changing in the short term. I suspect those discounts should return somewhat close to previous levels once the economy is up and running to a reasonable level.

- Fixed Rate Mortgages: I believe should come back down as the Bond markets settle – BUT – that might not happen, depending on how much higher the costs of supporting Canadian economy goes. And it could go up significantly.

- Note- as my friend Jeff Gunther said on a call today “when rates move they move quickly”. And I would add sometimes “also by a lot”.

- Lenders will reduce LTV limits in various markets. Some lenders will (and already have) vacate various markets and/or various products lines. One Monoline is out of the Prairies, another is out of both insured and uninsured lending in the Prairies, and two more are already out of uninsured lending in Alberta. This is driven by investors backing away from perceived risks, and by Monoline lenders’ volume capacities due to reduced staffing etc.

- Given that more than half of the mortgage industry (Brokers and Bankers) are working from home, allow 30 to 45 days minimum for purchases to close.

- Anyone who wants to switch lenders and has a maturity date (renewal date) in the next ~30-40 days closing should get confirmation in writing that the new lender can close that quick. If there’s any doubt, ask your existing lender to renew you into an open mortgage, if possible.

- Crystal Ball

- I don’t know about yours, but my crystal ball appears to be faulty over the last two weeks. Each day it shows me a different future.

- We are in uncharted waters. National economies world-wide are more interconnected than ever. There are more moving parts than ever before.

- Liquidity is the big risk issue over the mid and long term. The risk is whether or not it is manageable. Some pundits think it will eventually prove to NOT be manageable, that the BoC, CMHC and the federal government will run out of capacity to provide liquidity.

- We have been in an ultra-low interest rate environment for over a decade now. Many in the financial world have been predicting for several years an interest rate rise. Some base this in part on the growing under-funded pension liabilities created by such low rates for so long. John Mauldin is one of those.

- No-one knows where interest rates are going in the longer term. Rest assured they will go up and they will go down, but we don’t know when or in what order.

- I think we are beginning to see the amazing ingenuity and creativity that many people employ when the chips are down, and that makes me believe we will find our way through this without wide-scale destruction of our developed economies. Having said that, the risk is that if this goes very badly, it could well be worse than the 1930’s.

- What are we to do?

- Cash is King, so preserve your cash as best you can. Take all available payment and other deferrals that you can get. Preserve available capital in your HELOCs and PLC’s.

- Some people I know believe banks will selectively lower PLC limits or cancel some altogether. They go so far as to recommend you should take 75% of cash available in your PLCs now and put that money in an account at a different bank.

- If you want a home equity line of credit, apply yesterday. Recessions are not conducive to getting great deals on HELOC rates, but again, cash is king. And once you are out of work a HELOC will be more difficult to qualify for, notwithstanding the excellent suite of supports from various levels of government.

- If you get a 5-year fixed rate, try to pick a lender with a fair interest rate differential penalty (aka Monoline lender). The big-6 banks’ IRD penalties are on average roughly 2.5 to 3 times higher.

- For those who believe Prime will stay low and that Fixed rates will not climb much above current rates, a Variable rate mortgage may be the way to go until the Fixed rates market settles somewhat and those rates drop back down so you lock in.

- If you are truly concerned about, or if your financial stability is vulnerable to, interest rise shock, consider a 7-year or a 10-year term fixed rate mortgage. I have seen 7- year and 10-year rates as low as 0.6% to 1.0% above the 5-year Fixed rates recently.

- Note- These low long term rates tells us the some of the institutional lenders believe rates will indeed remain low for 7-10 years.

- Protect yourself in all your income and debt management decisions, and whatever you do, do it as fast as you can reasonably do it, and based on your risk tolerance. The less tolerance you have the more protective you should be.